Wagepoint Discovers the Goldilocks Zone of Growth

Published on

In the summer of 2017, my company Wagepoint found itself in an interesting position. We had uncovered new areas of growth that we could tap into to create exponential revenue growth.

The problem was that, at the time, it had yet to be proven.

Sure, we had some signed contracts and others were on their way to getting inked. But as far as traditional investors were concerned, those deals were still ‘in the pipeline’.

The hard reality is that it’s one thing to say you are going to unlock new areas for revenue growth, and it’s a whole other thing to demonstrate it. And when it comes to your typical equity-based funding from venture capitalists, only one of those two matters to your company valuation: the latter.

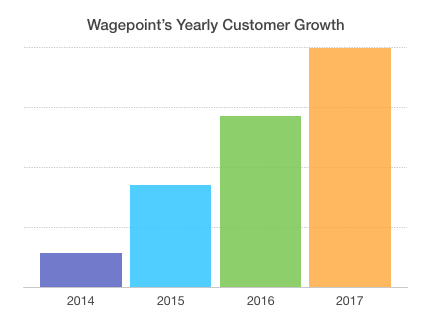

Since we launched in Canada in July 2013, Wagepoint — makers of payroll software built just for small businesses — had seen a doubling of revenue each year. This was primarily a result of obsessing over the customer experience, which in turn led to organic growth driven by word-of-mouth (WOM) from happy customers.

All that positive WOM in the small business and bookkeeper communities attracted the attention of Intuit — Canada’s leading accounting and financial management software — who was looking to partner with a payroll companyto introduce an advanced offering inside Quickbooks Online. At the same time, Wagepoint also closed deals with large accounting firms looking to add a significant volume of payroll customers over the course of their relationship. And to top it off, the company was also actively looking to expand into other HR apps with beta-launches of Track (Time and Attendance software), and Luna (Paid Time Off Management software).

With all this on the go, the Wagepoint management team had to decide on the best approach to fund all these growth opportunities that were in the pipeline, but where the associated revenue had yet to materialize.

Essentially, we were in the ‘Goldilocks Zone’ — we had all this great stuff happening that would have a positive — and hopefully exponential — impact on our revenue, but if we looked at equity financing at that point, we would be dinged in valuation because those opportunities were not productive as yet.

And that’s when we discovered the potential of revenue-based funding to close that gap.

We approached TIMIA Capital, a speciality financing company that provides pay-as-you-grow financing to companies in our exact sweet spot.

Lucky for us, the good folks at TIMIA understood exactly how to help us.

Andrew Abouchar, Chief Credit Officer, said of the time when Wagepoint presented its attractive growth prospects. “We connected with Shrad at the point where he understood how to scale his revenue,” says Abouchar. “He had the infrastructure in place to grow rapidly, and he needed capital to support that growth.”

Abouchar says the absence of dilution makes revenue finance an attractive option for growing companies like Wagepoint. “The big advantage for Shrad is that he’s getting the capital he needs at the right time and price, but he doesn’t face the dilution that an equity round would cause, so we’re essentially a non-dilutive alternative to equity financing.”

Like most Software as a Service (SaaS) companies, Wagepoint’s recurring revenue model lends some predictability to earnings over the long-term, but the biggest challenge for SaaS companies typically lies in finding short-term capital.

Since recurring revenue takes time to build up i.e. as you earn the revenue from customers over their lifetime, SaaS companies need to access short-term capital. However, if your SaaS company has growth prospects, borrowing against that growth is one way to limit dilution.

This makes TIMIA Capital a perfect fit for SaaS companies searching for funding once they have hit some traction.

On the Wagepoint side, we have been very happy with our decision to partner with TIMIA at this stage in our funding cycle.

As far as the investor-investee relationship goes, TIMIA Capital we have found the perfect balance, with TIMIA lending “just the right amount of value.”

As Abouchar says TIMIA’s relationship with Wagepoint is supportive, not managerial.

“We do talk to clients on a fairly regular basis, but we’re not part of the board or management team,” he says. TIMIA provides guidance that is rooted in their streamlined, metric-driven processes — and the company enjoys working with businesses that have an eye for success and an appetite for growth.

“We’re looking for people who have vision, who are motivated, and who are enthusiastic and want to grow their business because they see a really big opportunity,” says Abouchar.

So, how are we doing now?

Wagepoint serves over 4000 customers in Canada, making 55,000 direct deposits each month and moving $1.5BN in annualized payroll each month. We launched our partnership with Intuit and have just begun to start billing for our two new products — Track and Luna.

And we are just getting started.

Looking for non-dilutive capital?

TIMIA Capital works with recurring revenue technology

businesses between $2 – $20 million ARR.